Fine Beautiful Info About How To Claim Ebay Income

All income is to be reported on your form 1040.

How to claim ebay income. All sales tax you receive is set directly to the. To begin, navigate to ebay’s seller hub or my ebay, and click on the payments section. Selling items you made from a hobby?

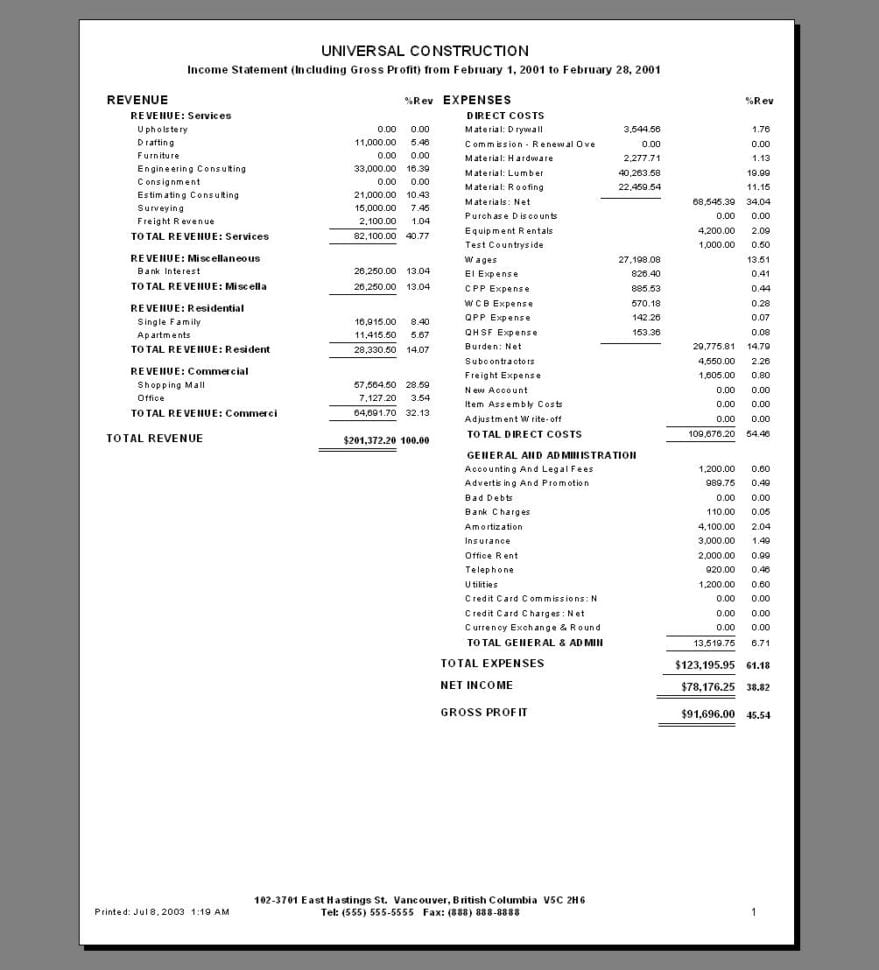

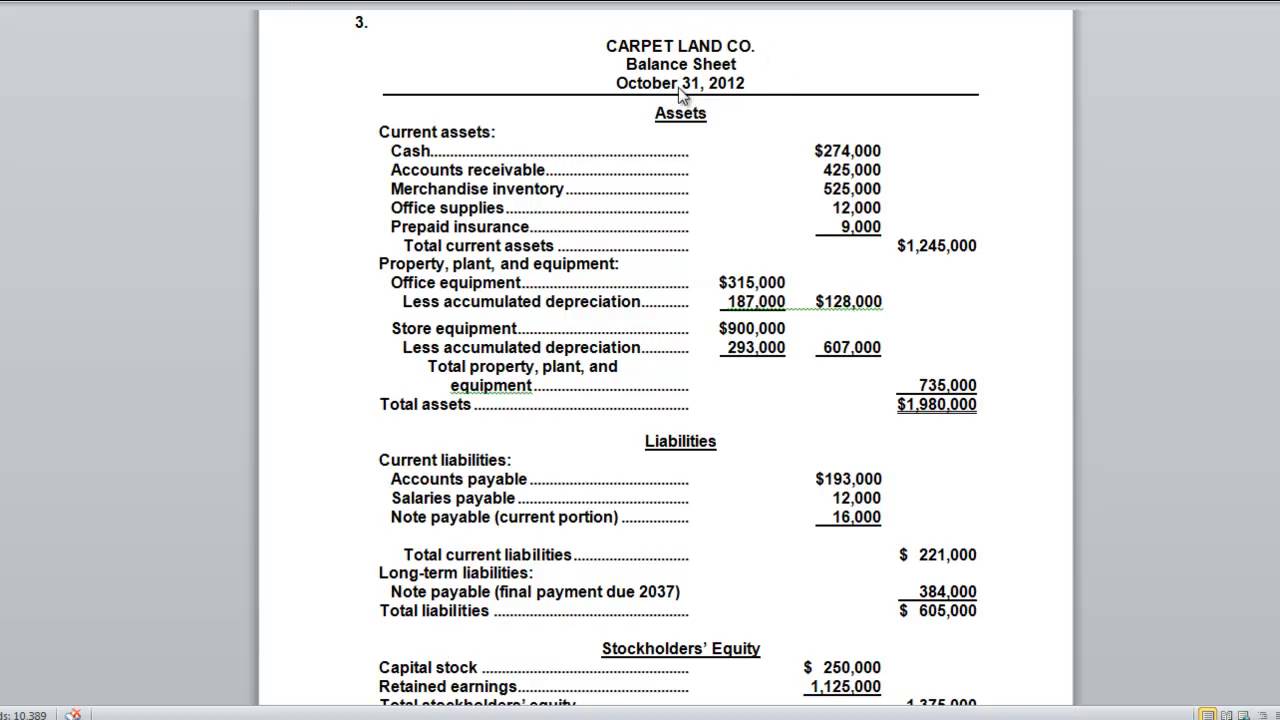

How does ebay's sales tax affect my income tax? You will not be allowed to deduct expenses at all. If your ebay sales for taxes rise to the level of a trade or business, you may claim your related deductions on form 1040,.

Hmrc’s ‘badges of trade’ regardless of how much money you make from sales on ebay, it’s important to be aware that hmrc may still deem your activity as. What forms of income are considered taxable? Paying income tax on ebay sales informing overseas buyers about import charges ability to validate what tax was collected on sales transactions.

Sales tax is already added to the sales price, so you don't have to pay income tax. What income tax forms are relevant to ebay ecommerce sellers and where can you find them? Rishi sunak has refused to express confidence in the post office chief executive after it emerged he asked for his pay to be doubled.

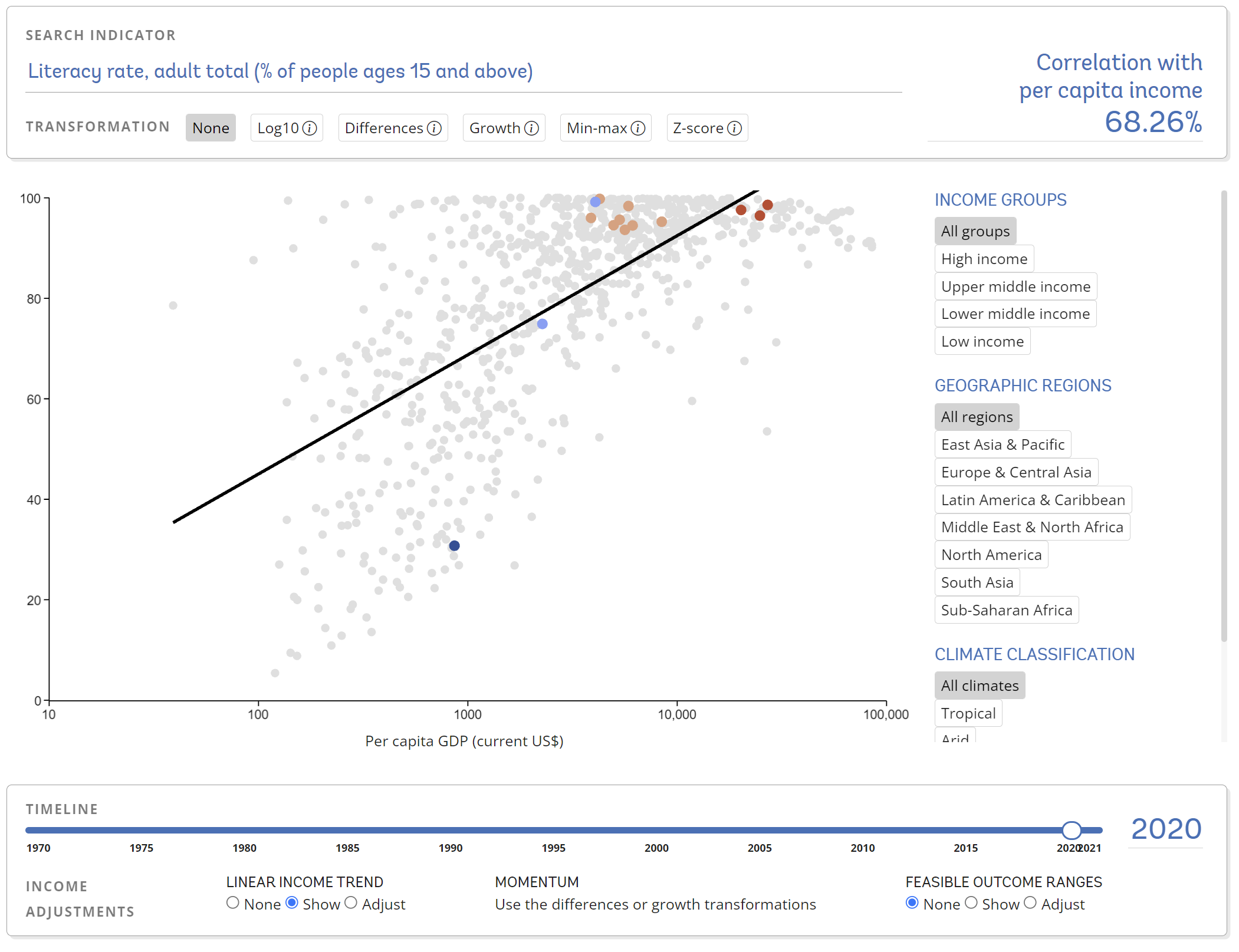

Investors and participants can access the call by. Internet sales tax in the us if you. This means you will have to report net income from ebay sales.

What type of taxes do i need to pay when selling on ebay? If ebay is required to collect such taxes in your jurisdiction, ebay will add the tax as a separate charge on your seller invoice or include the tax in our fees. Writing off your expenses as an ebay seller.

Not net amount that you. Will host a conference call to discuss fourth quarter and full year 2023 results at 2:00 p.m. Ki price/getty images) the internal revenue service (irs) has just issued a reprieve for anyone who gets paid for their goods and services.

Do you need to pay. If you have more than 200 transactions on ebay or make more than $20,000 in gross sales, you'll need to report that money to the irs and pay income tax on it. Updated december 28, 2022 (credit:

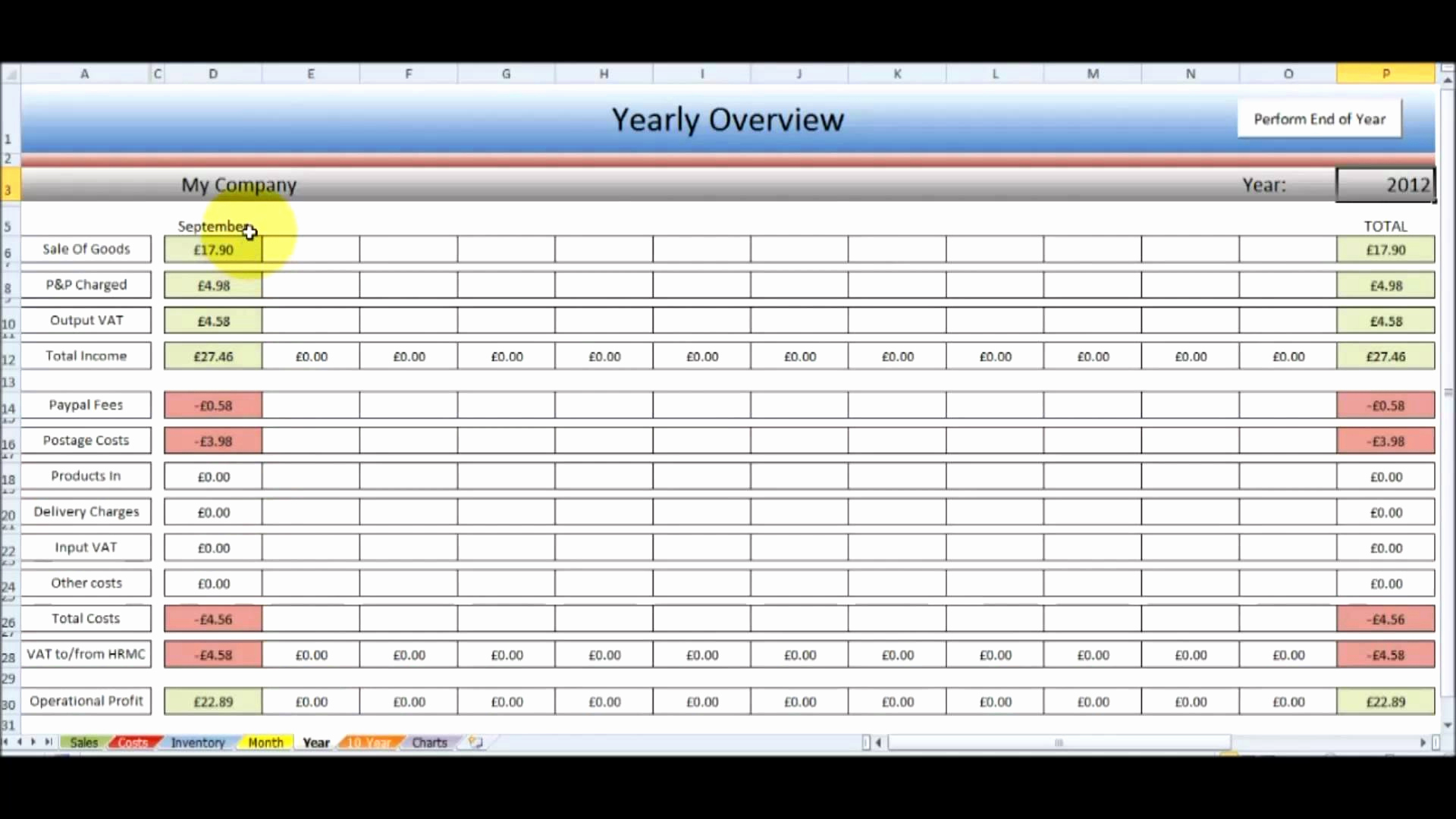

On this page, you will see. Once in the payments tab, click on another tab titled taxes. Although you need to report all profits and/or income from a hobby as well as a business, you’ll first need to determine whether you can report your sales as a hobby.

For example, if your income is. Irs requires you to report gross sales (purchase price + shipping income) total amount that you received from the customer.