Looking Good Info About How To Claim Fuel Rebate

Who could claim a regional fuel tax rebate.

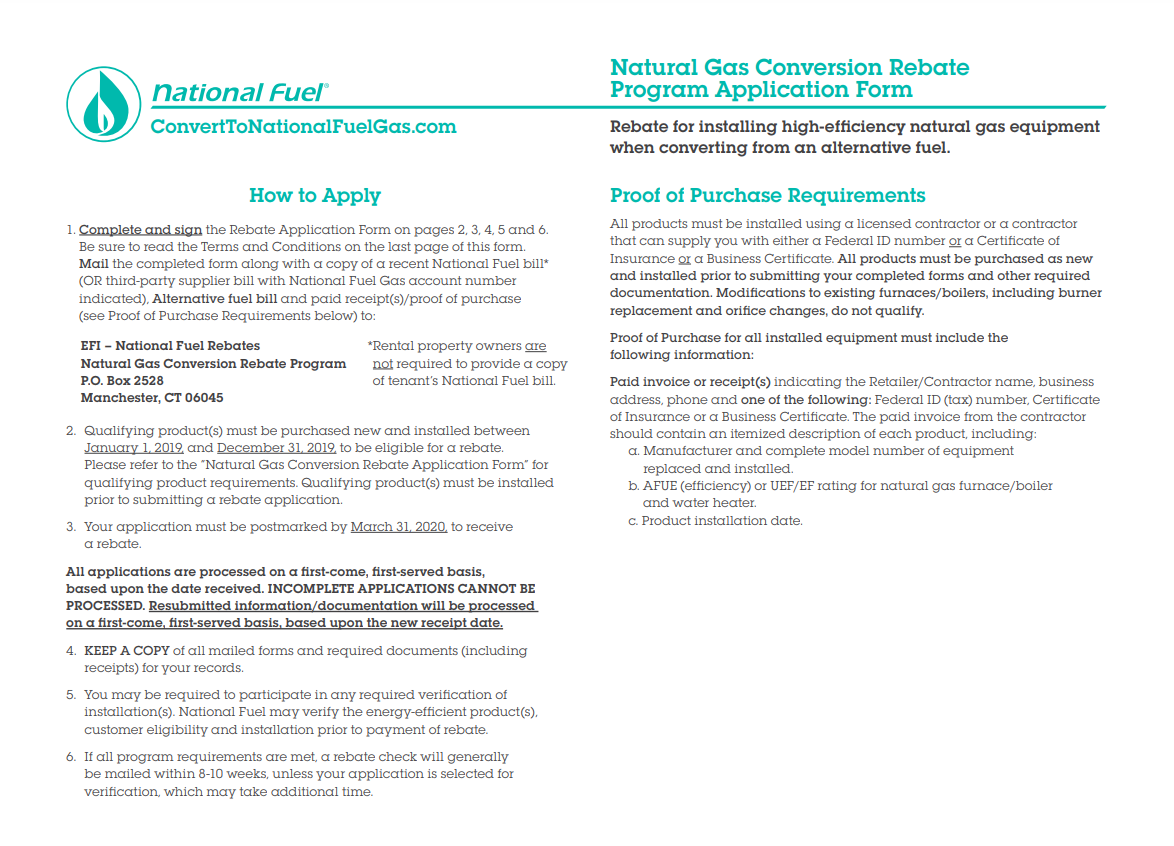

How to claim fuel rebate. You can claim credits for the fuel tax (excise or customs duty) included in the price of fuel used in business activities. You can only submit one rebate claim per period. You’ll also need to record how much of that fuel is used in each of the vehicles, vessels,.

Check if you’re eligible for fuel tax credits. Details for retailers selling unleaded petrol and diesel as road fuel, and eligible to claim relief, you can either: Use the online service fill in the print and post form.

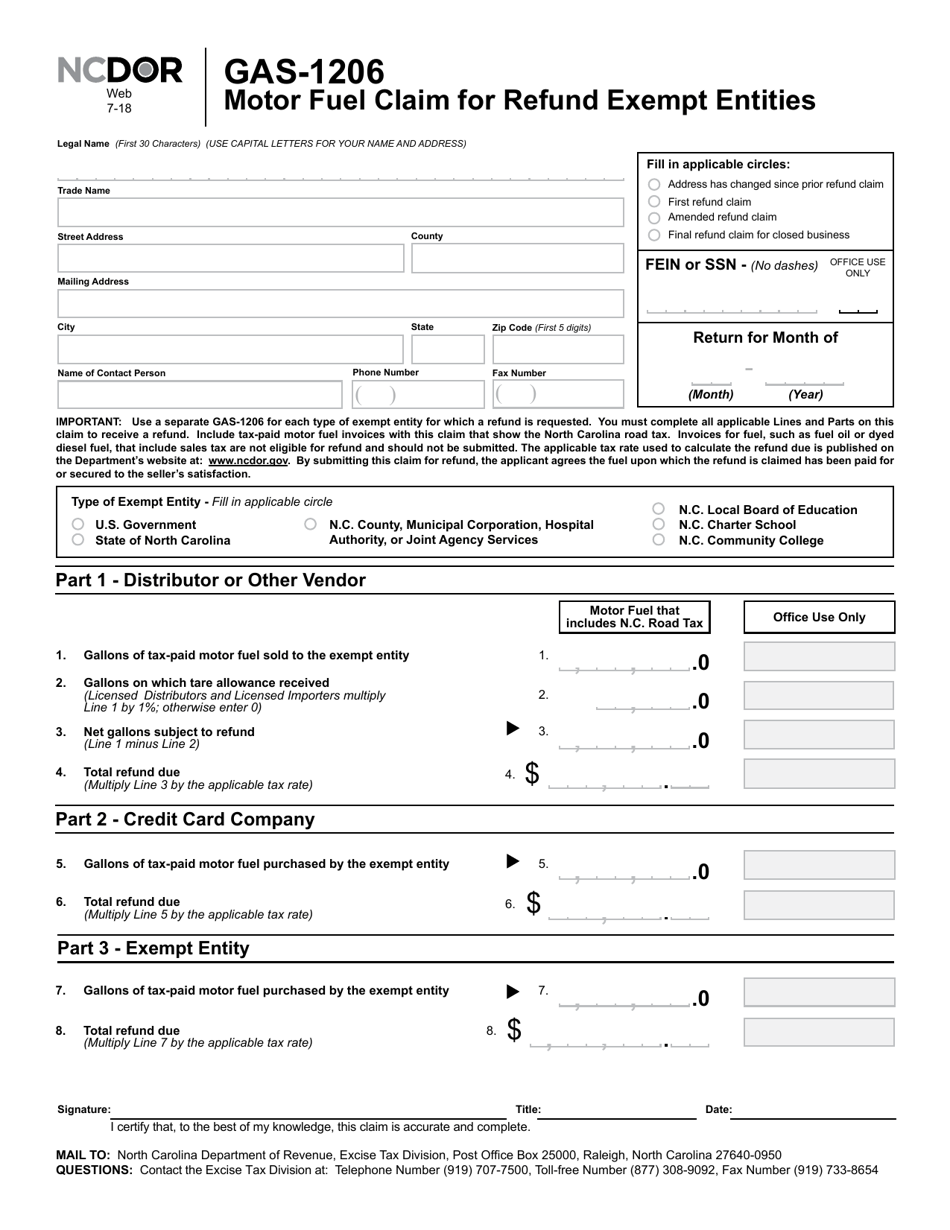

Fuel tax credits are assessable income, and should be disclosed in the tax return as “assessable government industry payments”. To make a claim for fuel tax credits, you must be registered for: The fuel was used for commercial purposes, government or charitable organisations, and the fuel wasn’t.

The initial regulations provided the same entitlements to regional fuel tax rebates as those available for the refund of ped. Use form 4136 to claim a credit. They are also treated as installment.

To apply for a diesel rebate, you will need your: Credits and deductions under the inflation reduction act of 2022. 5 ways to save in.

Transport operator’s licence number transport manager's certificate of professional competence number tax. If all my fuel purchases are on my. You can claim for taxable fuel that you.

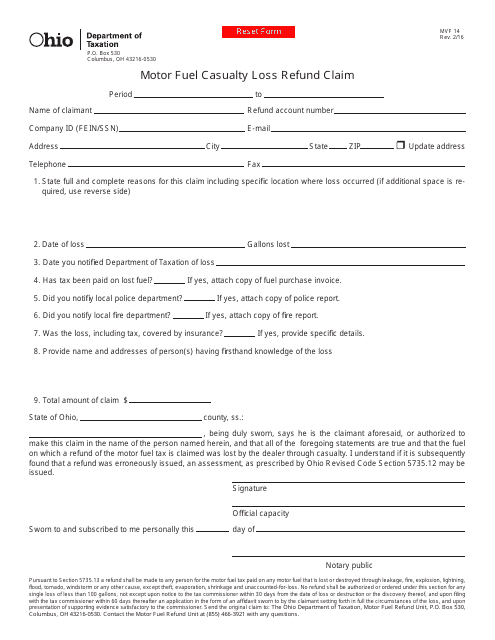

1818 (august 16, 2022), commonly known as the inflation reduction act, retroactively reinstated and extended the following. You may be able to claim back regional fuel tax you paid if: Find out how to get started.

Similarly, you could combine a heat. Understanding eligible vehicles and fuels for claiming. Interactive guide to energy credits available under the inflation reduction act.

Make sure you include all eligible purchases for the entire period. You can claim a rebate of rft paid on eligible fuel use. Fuel cell property is limited to $500 for each half kilowatt of capacity.

Last updated 30 january 2024 print or download fuel tax credit rates you need to use the rate that applies on the date you acquired the fuel. You can claim tax relief on the money you’ve spent on fuel and electricity, for business trips in your company car. Keep records to show the actual cost of the fuel.